On line programs such Airbnb and you can Vrbo have made this a lot more popular. Treliant will bring designed ways to seamlessly include the newest advised rule on the influenced functions’ doing work process. With complete training, smooth reporting architecture, and continuing help, Treliant might help companies, and lawyer, efficiently use the brand new reporting requirements and lower disturbances in order to “business as usual” procedure. An alternative Several months is actually amount of time determined by the brand new package, have a tendency to four in order to two weeks, when the customer is also check the property to see whether he/she really wants to continue the purchase of the house. A small percentage, the option Commission, is actually paid back as the thought for it several months.

See site | Discover your loan conditions, rates, and more!

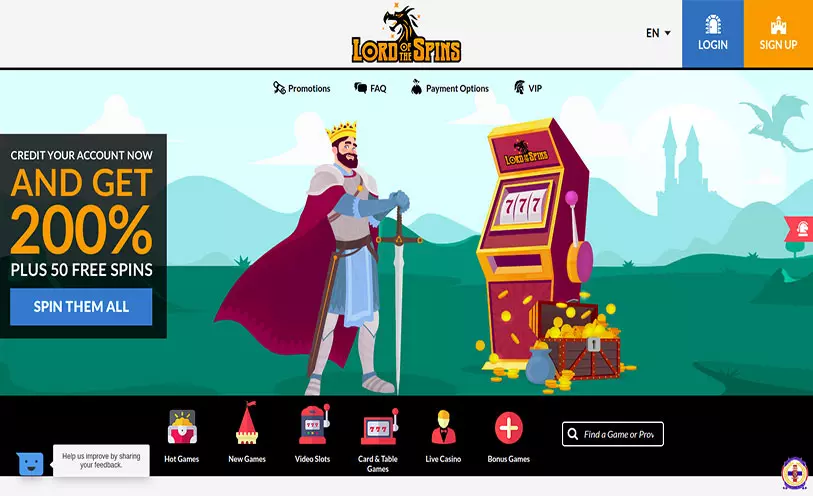

Baccarat is yet another property-dependent gambling enterprise essential who may have and mature popular online. Professionals appreciate their see site convenience and you may expert possibility, having Banker bets going back nearly 99%. Because of its ease and relatively a odds, roulette is now one of the most well-known on the internet casino games. Online casino harbors are supplied from the dozens of higher-character games manufacturers, along with NetEnt, IGT, Konami, Everi, High 5, Konami, Aristocrat, White-hat Gambling, and you can Relax. Slots control internet casino libraries, spanning regarding the 90% of the collection.

Are a property REITs a no-brainer?

The phrase “home-based tough currency” whenever regarded within the home funding, is basically a low-bankable financing on the an investment single house (or duplex). The name domestic difficult money is apparently interchanged that have “no-doc”, individual fund, connection finance, etc… To own a domestic difficult currency mortgage, the new underwriting behavior are based on the newest borrower’s hard property. In this case the new residential investment a property might possibly be put because the guarantee (through a primary home loan) on the deal. Residential Tough money closes rapidly (inside less than three or four months with respect to the circumstances). Buyers can be be eligible for money no matter their credit scores otherwise nationality. Extremely asset-based private money lenders investment doesn’t focus on personal obligations otherwise credit score when designing a lending choice.

Simple tips to Purchase Home: 5 Easy Tips for Newbies

FinCEN needs that obligation so you can document A home Account perform essentially affect payment agencies, name insurance coverage agencies, escrow agencies, and you will attorney. The newest NPRM, although not, designates only one reporting person for the offered reportable transfer, that is decided in another of a few indicates, the new Reporting Cascade or from the created arrangement. You could also getting an arduous money lender, however you’ll need some investment. So it probably isn’t likely to be the initial means you start away making profit home, however, because you create your network, investment, and you will a substantial portfolio of sale, you can offer such connection money and then make a great rates from go back.

REITs

Once acknowledged, Northern Coastline Monetary can be finance the loan inside the as little as 3-five days for money spent. Holder filled finance usually take 2.5 weeks due to the most recent government laws that every lenders need adhere to. The brand new report must be recorded by after time of both (1) the very last day of the brand new week following the week where the new reportable transfer takes place; or (2) 30 schedule days following day out of closing.

By making a part hustle (otherwise full-time community) away from domestic a property, you may make an established source of income. Even when a house opportunities is actually smaller liquid and can be more time-drinking than just organizing your savings to the stock market, the potential for secure inactive income and a varied money portfolio can result in a desirable benefit the buyer. At the GreenBridge Money, we understand exclusive challenges and you will possibilities against domestic a home investors now.

Commercial Using: Production and you will Dangers

Yet not, anticipate large upfront will cost you, along with off money away from 20-30% or even more, and you will account for the elevated rates of interest. Despite such can cost you, independence within the loan structuring and fast approvals generate hard currency financing a very important equipment to own household flippers centering on fast investment completions. Regarding the RealPageLocated in the Carrollton, Tx, a suburb away from Dallas, RealPage brings to your demand (also called “Software-as-a-Service” or “SaaS”) services and products so you can apartment communities and solitary loved ones rentals round the the usa.

Naturally, it means going for all the way down-listed home otherwise upset features and you will turning deals. It also function trying to find tough-currency loan providers or any other traders that will help push selling as a result of. This could even affect house renovations so long as you’lso are proficient at finding the currency. All-bucks requests out of domestic a house are believed in the high-risk for money laundering. All of our members of the family during the Chicago Identity Insurance agency have common details about a different rule appropriate so you can low-funded home-based a house transmits where consumer try an enthusiastic organization otherwise faith.

If the, such, the house field climbs dramatically, you should buy you to possessions at a discount. You could also change market the rights for the purchase to someone else. For as long as this really is an option you could potentially get it done and you will not at all something place in brick you to claims you have got to purchase at the end of the brand new book regardless, then you may very well turn a profit.

To incorporate self-reliance and reduce compliance burdens, the very last Laws incorporates a “cascade” system to choose first submitting obligations and you can lets globe advantages to help you designate compliance requirements certainly one of by themselves. Banking institutions or any other organization lenders routinely have rigid lending conditions and that causes of a lot individuals which have its loan applications refused. Earnings background and you can borrowing are usually area of the conditions the banks work at. Items such bad credit, and you will previous foreclosures, bankruptcies, financing adjustment otherwise short transformation is going to be warning flags to an excellent lender. Draw collateral from assets in order to pick some other property is a common technique for of many a home buyers. Lead difficult money financing enable it to be investors to complete cash-out refinances right away, making it possible for the newest individual so you can capitalize on an alternative a house opportunity.

Depending on the financing, rates of interest begin only 7% since composing. The shape often ask you to define whether you are seeking a buy or home mortgage refinance loan, your local area on your techniques, the spot of the home and also the financing program of interest. For the reason that homebuilders’ can cost you increase that have rising prices, and that must be passed away so you can people of the latest home.